The NYSE’s view of going public and selling securities in the capital markets

As you go through the process of leading a high-growth company through an IPO, one of the most important decisions is selecting the right market for listing the company’s securities.

Global exchange overview

According to the World Federation of Exchanges, as of December 31, 2016, the Americas had the highest domestic market capitalization, which reached $31 trillion, followed by Asia Pacific at $23 trillion. The New York Stock Exchange (NYSE) is the largest and most liquid exchange compared to all other exchanges globally. As of December 31, 2016, NYSE had cumulative domestic capitalization of $19.6 trillion, with the Nasdaq second at $7.8 trillion. In addition, as of December 31, 2016, the NYSE leads as the most liquid exchange, trading 20 percent of total cash equity, followed by Nasdaq at 13 percent. This can be attributed to NYSE’s unique market model that is designed to maximize liquidity, encourage market activity, and help participants trade more efficiently. See Figure 1.

Why list in the United States?

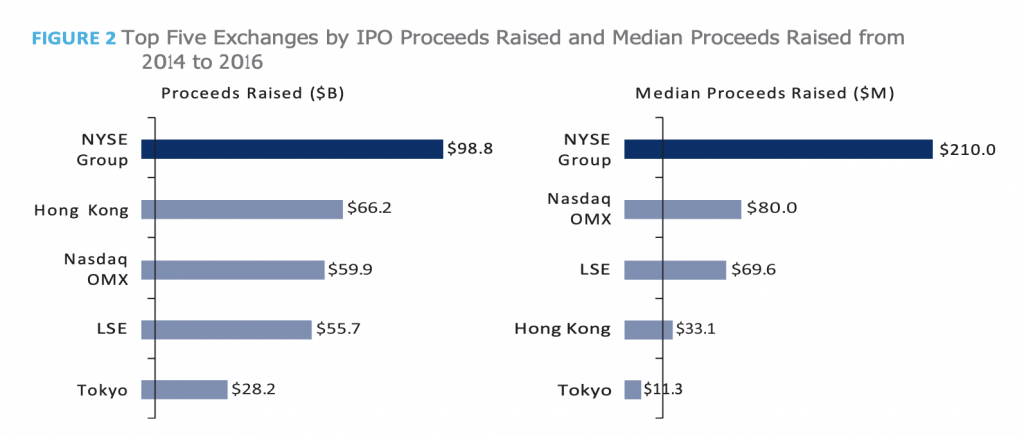

U.S. capital markets are viewed as the destination of choice for investors and companies alike as they provide unparalleled liquidity, diversity, cross-border capability, and, as a result of the 2012 JOBS Act, regulatory and financial reporting relief. From 2014 to 2016, $522 billion was raised from IPOs. With 619 IPOs, U.S. exchanges represented 28 percent of proceeds raised. There are currently four exchanges in the United States where companies can raise capital. The NYSE led with $98 billion in proceeds raised for the same time period. See Figure 2.

For companies backed by venture capital (VC) or private equity (PE), follow-ons also become an important decision factor. Follow-on activity remains equally strong in the United States. See Figure 3.

Does equity market structure matter?

The U.S. equity market structure rules are developed and enforced by the Securities and Exchange Commission (SEC). An underlying principle of these rules is to ensure that market participants executing orders on behalf of investors seek out the best execution for that order—this often translates to the best available price, and it is the broker’s responsibility to secure it.

SEC rules implemented in 2007 placed a regulatory emphasis on achieving the best price for each order by promoting competition among exchanges. In order to compete, the SEC required exchanges to become fully automated and immediately accessible. This led to a proliferation of electronic exchanges and other more opaque electronic trading platforms known as dark pools. Today there are 13 exchanges and more than 50 dark pools available for executing orders.

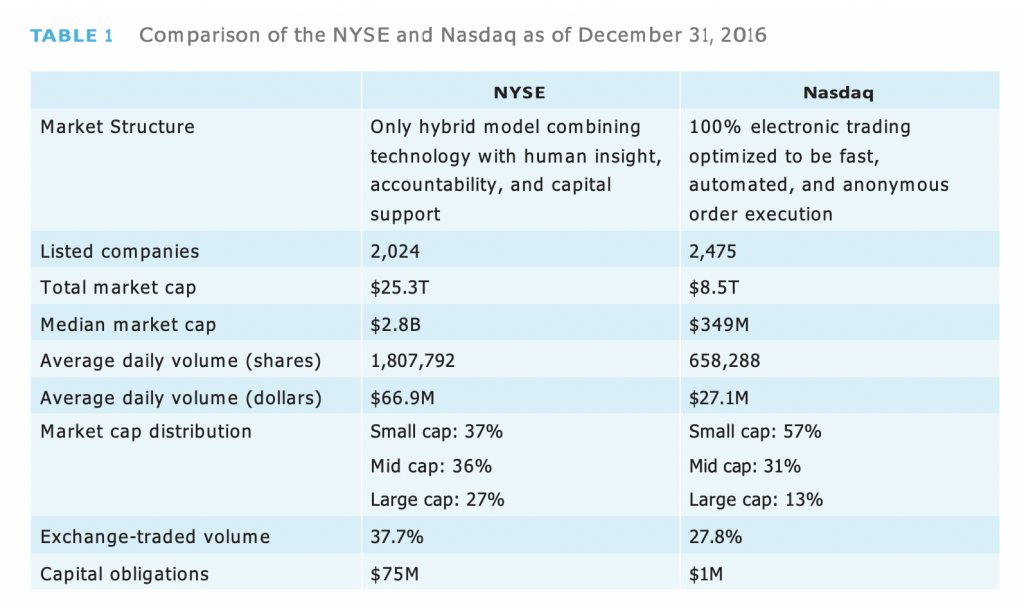

The growth of the number of trading venues has increased the level of competition among trading venues and reduced costs to trade; however, this has also resulted in a more fragmented marketplace. Although this has achieved lower costs of trading, it has increased the fixed costs associated with connecting to multiple venues. Such fragmentation also makes it harder for institutional investors to source liquidity. Table 1 provides a brief comparison of the U.S. listing exchanges.

Other exchange considerations

In addition to the market structure and access to capital, there are other key considerations when deciding on the listing venue.

Trading Model

The NYSE is the only exchange in the world that combines leading technology with human judgment to prioritize price discovery and stability over speed. Nasdaq offers electronic trading optimized to be fast, automated, and anonymous. The cornerstone of the NYSE market model is the Designated Market Maker (DMM). DMMs have obligations to maintain fair and orderly markets for their assigned securities. They operate both manually and electronically to facilitate price discovery during market opens, closes, and during periods of trading imbalances or instability. This high-touch approach is crucial in order to offer the best prices, dampen volatility, add liquidity, and enhance value.

Global reach and visibility

The two main U.S. exchanges, NYSE and Nasdaq, are well known. Being listed on the NYSE or Nasdaq may help companies find new investors more easily, add credibility with customers and vendors, and inspire confidence in their overall market position.

The opening and closing of the trading day garner concentrated media attention and provide a company on its listing day unique opportunities to gain immediate global visibility. For example, the NYSE’s Opening Bell is broadcast across 33 channels. Furthermore, many listed companies return to the exchanges after their IPO multiple times a year to use their facilities for analyst, investor, or board meetings as well as corporate announcements, media interviews, and events.

Network as a business platform

In addition to the important company debut on the occasion of a company’s IPO, another key venue consideration is to list among peers, customers, and partners. That commonality may facilitate better connections to help drive business objectives. Additionally, exchanges also host events that provide networking opportunities and relationship development within its listed company community.

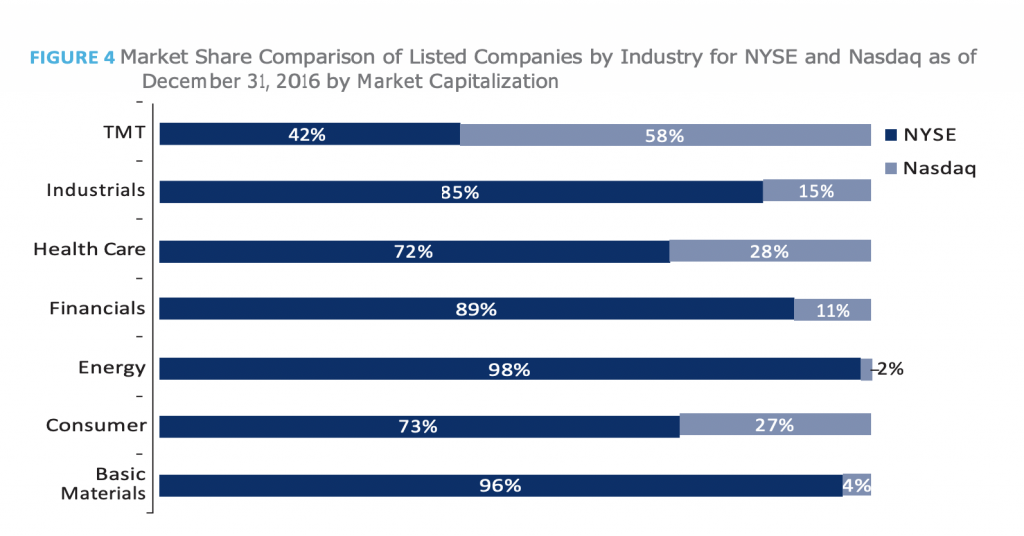

Many of the leading established companies from technology and health care to energy and industrial are traded on the Big Board. For example, 90 percent of the Dow Jones Industrial Average and 77 percent of the S&P 500 are listed on the New York Stock Exchange. Furthermore, between 2014 and 2016, NYSE continued to list the larger companies, where 57 percent and 45 percent of the IPOs that chose to list on NYSE had a market capitalization greater than $700 million and $1 billion, respectively. In contrast for the same time period, 56 percent and 41 percent of the IPOs that listed on Nasdaq had a market capitalization of less than $300 million and $200 million respectively.

From an industry sector perspective, both exchanges are highly diversified. See Figure 4.

However, as noted previously, the size of the companies is significantly different between the two exchanges where the median market capitalization of the listed companies for NYSE and Nasdaq is $2.8 billion and $349 million, respectively.

Investor relations services

Another important factor when considering a listing venue is the quality of customer service and the solutions that will help the management team after its IPO. Being a public company offers increased access to the capital needed to continue innovating and growing, but it also places new requirements on companies.

Executives and investor relations officers (IROs) are on the front line, delivering corporate strategy and financial reports to shareholders and facilitating shareholder feedback and insights back to corporate boards. Companies are increasingly relying on chief financial officers (CFOs) in developing corporate strategy, in addition to their being responsible for capital management, financials, audits, and strategic investments. IR teams are also becoming more involved in internal and external communications, competitive intelligence, media relations, and other corporate initiatives in addition to financial reporting. Thus, the exchanges’ ability to provide robust analytics and shareholder intelligence, as well as to provide direct access to market traders, as part of the IR toolkit, is paramount to helping a company manage a well-run investor relations program.

Sidebar

Elements in evaluating the quality of the IR toolkit include:

Best-in-class versus one-stop shop: The NYSE teams up with the leading providers of webhosting/website design solutions, market analytics, surveillance services, and news distribution. Nasdaq has chosen a different strategy of acquiring various companies over the years to provide these stand-alone services directly.

Direct access to traders to gain market information and insights: For NYSE-listed companies, IROs and CFOs can directly contact the designated market maker who has specific obligations related to each issuer’s stock and can provide real time information to evaluate the stock.

Ongoing issuer services program: Each exchange provides access to data and analytical tools, but with varying degrees of functionality and cost. The NYSE, however, is the only exchange to provide complimentary issuer services (webhosting, market analytics, surveillance services) for qualified listed companies, based on the shares outstanding.

Community events: Access to the IR community through summits, webinars, and roundtables helps foster sharing best practices and networking.

Venue for investor events: The NYSE recently completed a significant renovation of its landmark building and increased event capacity by 40 percent. Furthermore, the space is complimentary to the listed community and can be used to hold various business functions including analyst and investor days, board meetings, and customer events.

New York Stock Exchange