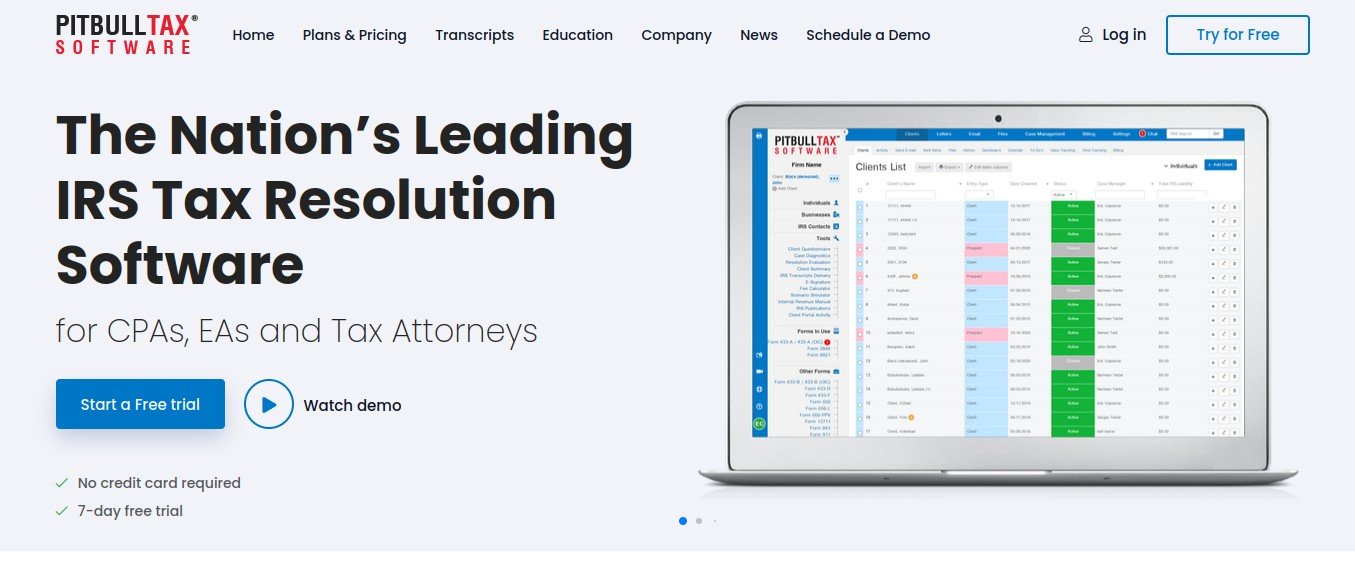

PitBullTax is an online application for tax resolution professionals. It allows Enrolled Agents, CPAs and Tax Attorneys in the United States to organize their IRS representation cases, and to work them faster and confidently.

PitBullTax includes all the tools that are necessary for the work, including:

- Different ways to gather information about a client’s tax debt case, including a client questionnaire, an accounting client portal, and the ability to request taxpayers’ tax transcripts from IRS servers.

- Analytical tools, to identify quickly what is the best solution for each client’s situation, including a resolution evaluation tool, case diagnostics and scenario simulator to confirm your findings.

- All the forms a tax professional may need to carry out a successful representation, including previews of how they will look like before you print them to have them signed.

- Many templates to speed up every process, including power of attorney, engagement letter and other customizable templates.

- A full, searchable, IRS Manual plus several tips throughout the application

- Tools for the tax professional such as a fee calculator, a workflow manager and a calendar

- Integration with Zapier, Zoom, DropBox, OneDrive and Google Drive.

Those were just examples. PitBullTax has many other features to explore.

Tax professionals may also purchase add-ons and enhance the software potential. For example:

- The IRS Transcripts Delivery and Reporting system (mentioned above) allows tax pros to request their clients’ transcripts from IRS servers.

- The Case Management and Billing add-on allows tax practices to manage their invoicing.

- The Payment Processor add-on allows them to charge clients’ online.

As if that were not enough, PitBullTax is an Approved Continuing Education Provider by both IRS & NASBA. PitBullTax Institute allows taxpros to earn accounting continuing education credits by attending PitBullTax’s workshops and seminars.

- PitBullTax tax resolution software

- PitBullTax Transcripts

- PitBullTax Institute for accounting CPE in IRS representation