409A valuations and other complex equity compensation issues

Background

Valuation of various equity classes issued by an enterprise, sometimes within a complex capital structure, can be a daunting but necessary exercise for a private company when certain key milestones occur (e.g., exploring another round of financing or granting share-based compensation to employees) or for meeting tax and financial reporting requirements. The sections below will offer a thorough explanation of the valuation process and will describe the key features of various

instruments commonly encountered when valuing equity classes within a complex capital structure. This article is not intended to provide specific accounting or tax guidance. Moreover, given the complexities involved, this article will focus on the overall goal and intent of the valuation techniques versus extensive discussion on option theory or nuances underlying the approaches.

Basics

Securities within complex capital structures predominantly include preferred stock, common stock, and share-based awards.

Preferred stock: The rights of preferred stock can be divided into two broad yet distinct categories—economic rights and control rights. Economic rights offer an advantage to preferred stockholders as compared to common stockholders, since these rights directly correlate with the timing, preference, and amounts of returns these preferred stockholders receive. Control rights ensure that preferred stockholders can influence or control the enterprise in ways that are disproportionate to their ownership percentages.

Common stock: Common stock represents the residual claim on enterprise value after debt and preferred equity holders have been repaid. Common stock is typically the foundation for benchmarking the relative ownership percentage of the various classes: ownership interests related to preferred equity and share-based awards are often expressed as a percentage of their fully diluted common share equivalents.

Share-based compensation: This may include various derivative instruments; chief among these instruments are options, which allow holders to purchase or sell a certain amount of equity shares in a company at a predetermined price, referred to as the “strike price” or “exercise price.” It may also include awards of restricted or nonvested stock (i.e., stock that is not fully transferable until certain conditions, such as years of service or certain performance targets, have been met).

When and why is a valuation needed

Valuations play a critical role in tax reporting, financial reporting, and in informing strategic decisions. Additionally, stakeholders who have made an investment in a private enterprise or an investment in a subset of a public entity may require a valuation to understand the performance of their investment on an interim basis.

Tax purposes

A timely valuation of an enterprise’s shares may be required for tax compliance if management plans to issue share-based awards in the form of options or restricted stock. Here are two common examples:

IRC 409A Nonqualified Deferred Compensation Plans: Section 409A of the Internal Revenue Code (IRC) calls for a holder of an in-the-money option (i.e., the fair market value (FMV) of the underlying share exceeds the exercise price) at the grant date to recognize taxable income equal to the difference between the FMV of the shares and the exercise price as they vest. The applicable combined federal and state tax rate upon vesting may be as high as 85 percent or more in some cases. Option holders who receive awards that cannot be shown to be at- or out-of-the money on the grant date may face immediate tax upon vesting at the rates described previously. Therefore, it is particularly important for companies to establish the FMV of the shares at the option grant date using valuation methodologies presented within this article.

IRC 83(b): The recipient of an equity interest subject to vesting may elect to be taxed upon the FMV of the shares at the grant date by providing notice to the IRS within 30 days of the grant date. If no election is made, the recipient would typically pay ordinary income tax based on the FMV of the shares upon vesting.

Financial reporting purposes

Financial reporting guidelines frequently recommend disclosures to aid investors. Accounting guidance may require companies to disclose the value associated with derivative instruments.

Valuations of grants of share-based awards are often required to establish compensation expense (in the case of grants to employees under Accounting Standards Codification (ASC) Topic 718, Compensation—Stock Compensation) or to account for distributions to shareholders under ASC Topic 505, Accounting for Distributions to Shareholders with Components of Stock and Cash.

In addition, situations may arise when warrants may be required to be valued separately from the instruments to which they were attached in accordance with ASC Topic 815, Derivatives and Hedging and ASC Topic 820, Fair Value Measurement.

Strategic purposes and goals

Valuation can be essential to the process of raising capital. A valuation of the enterprise is a key consideration in the amount, ownership interest, and form of an equity raise. A valuation of the enterprise or certain assets may also be helpful to secure debt financing. Moreover, the techniques described later in the article are helpful to understand the value exchanged or potential dilution associated with issuances of subordinated securities—either to motivate employees or to attract investors with higher return targets.

Total equity valuation approaches

When appraising various security interests within a private entity, specialists typically establish the value of total equity by first valuing the enterprise. Valuation specialists employ a variety of methods to determine value, but each of these methods may be classified as variations on one of three approaches—market, income, and asset-based approaches. Generally, valuation specialists will consider the result from one or more methods in determining value based on the needs of the particular client and situation.

Income approach: This approach recognizes that an investment’s value is determined by the potential receipt of future economic benefits. The discounted cash flow (DCF) method—which involves estimating the future cash flows of a business and discounting them to their present value—is a form of the income approach that is commonly used to value business interests. The discount rate applied in the DCF Method is established based on the risks inherent in the investment and market rates of return; these risks are determined by a careful consideration of alternative investments that are of a similar type and quality.

Market approach: This approach assumes that companies operating in the same industry will share similar characteristics and that the company values will correlate with those characteristics. Therefore, a comparison of the subject company to similar companies whose financial information is publicly available may provide a reasonable basis to estimate the subject company’s value. There are two commonly applied forms of the market approach:

- The guideline public company (GPC) method: The GPC method provides a value estimate by using multiples derived from the stock prices of publicly traded The GPC method involves developing earnings or book value multiples based on the market value of the guideline companies and applies these multiples to the corresponding metrics of the subject company to estimate value.

- The guideline merged and acquired company (GMAC) method: This method is conceptually similar, but the multiples are developed based on observed transaction prices rather than the market capitalization of publicly traded peer companies.

The asset approach: This approach considers reproduction or replacement cost as an indicator of value. This approach assumes that a prudent investor wouldn’t pay more for any entity than the amount that he or she could use to replace or re-create it. Valuation professionals will use historical costs to estimate the current cost of replacing the entity valued. In the asset approach, the equity value of a business enterprise is calculated as the appraised value of the individual assets and liabilities that comprise the business.

Once enterprise value is determined, as described above, the specialists can subtract the value of debt to arrive at the total equity value.

Equity allocation approaches

The valuation techniques and examples described in the remainder of this article leverage heavily upon discussion in the revised AICPA practice aid, Valuation of Privately- Held-Company Equity Securities Issued as Compensation. This publication is often referred to as the “cheap stock” practice aid.

Simple capital structure

In the context of a simple capital structure (i.e., comprised of only one class of equity), total equity is divided by the number of shares outstanding to derive the share price.

Complex capital structure

Complex capital structures, which have multiple equity classes, require more complex allocation methodologies to derive the value of each equity class. This section highlights the techniques utilized to determine the value of distinct equity classes in a complex capital structure.

Current value method (CVM): This allocation methodology is based on an estimate of total equity value on a controlling basis assuming an immediate sale or liquidation of the enterprise. Once that estimate is established, specialists allocate value to the various series of stock based on those series’ liquidation preferences or conversion values, whichever would be greater.

The fundamental assumption of the CVM is that each class of stockholders will exercise its rights and achieve its return based on the enterprise value as of the valuation date, rather than at some future date. Accordingly, preferred stockholders will participate either as preferred stockholders or, if a conversion feature is available and would be more economically advantageous, as common stockholders. Common shares are assigned a value equal to their pro rata share of the residual amount (if any) that remains after the liquidation preference of preferred stock is considered.

However, because the CVM focuses exclusively on the present, it is generally appropriate to use in two very specific circumstances:

- When a liquidity event in the form of an acquisi- tion or a dissolution of the enterprise is imminent, and expectations about the future of the enter- prise as a going concern are virtually irrelevant; or

- When an enterprise is at such an early stage of its development that (a) no material progress has been made on the enterprise’s business plan, (b) no significant common equity value has been created in the business abovethe liquidation preference on the preferred shares, and (c) no reasonable basis exists for estimating the amount and timing of any such common equity value above the liquidation preference that might be created in the future.

In situations in which the enterprise has progressed beyond the venture stage, valuation specialists will use other allocation methods.

Fact pattern I: illustrative example using CVM

To illustrate, consider the purchase of a business on January 1, 2016, with a capital structure and buy-in details as shown below:

For simplicity, assume the preferred stock is not entitled to dividends, nor does it have any conversion or participation rights. Now, consider a valuation for the enterprise is performed as of January 1, 2017. The common equity value implied under the CVM is as follows:

Because the preferred shareholders have liquidation preference equal to the value of the enterprise, no residual value is available to the common shares under the CVM. Note this assumes there was an imminent liquidity event at the time the enterprise was valued.

The option pricing method (OPM): This allocation methodology treats common stock and preferred stock as call options on the enterprise’s equity value, basing exercise prices on the liquidation preferences of the preferred stock. Common stock has value only if the funds available for distribution to shareholders exceed the value of the liquidation preferences at the time of a liquidity event such as a merger or sale - assuming the enterprise has funds available to make a liquidation preference meaningful and collectible by the shareholders. The common stock is modeled as a call option that gives its owner the right, but not the obligation, to buy the underlying equity value at a predetermined or exercise price.

The OPM has commonly used the Black-Scholes option pricing model to price the call option.

This method considers the various terms of stockholder agreements—including the level of seniority among the securities, dividend policy, conversion ratios, and cash allocations—that can impact the distributions to each class of equity upon a liquidity event. The OPM also implicitly considers the effect of the liquidation preference as of the future liquidation date, not as of the valuation date. Many practitioners believe this makes it the most appropriate method to employ when specific future liquidity events are difficult to forecast.

Fact pattern II: illustrative example using OPM

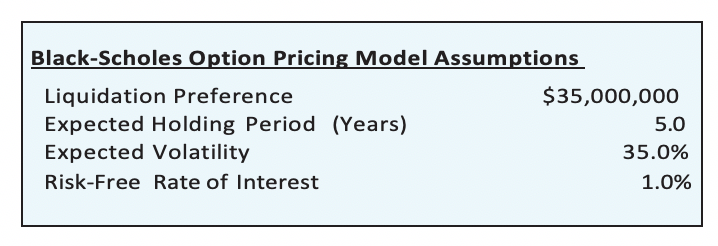

For the same business described in the earlier example, management anticipates an exit in five years. The following assumptions are necessary to complete the Black-Scholes option pricing model:

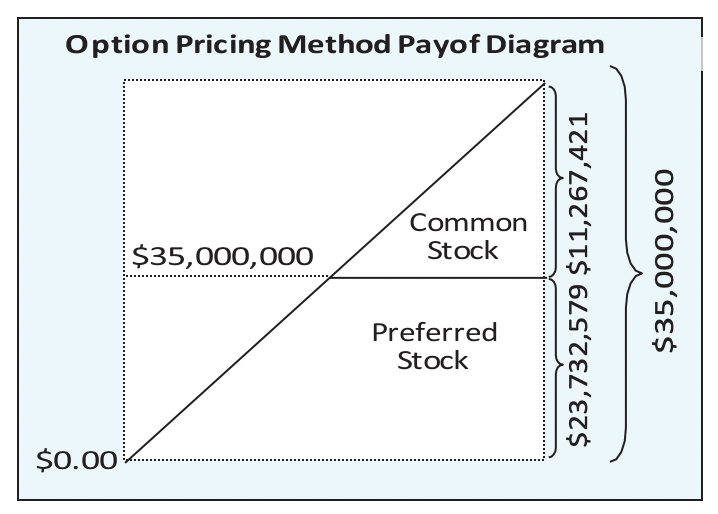

The OPM would allocate the equity value between the preferred stock and common stock as follows:

As shown in the figure, this model assumes the common stock would have a claim on any appreciation in the equity value above $35 million. Intuitively, the preferred stock is now worth less than the original purchase price because the equity value declined by 12.5 percent since purchase and due to anticipated future dilution from common. In contrast, the common stock continues to hold an option to participate in the appreciation of the business over the holding period.

The probability-weighted expected return method (PWERM): This allocation methodology estimates the value of the various equity securities through an analysis of future values for the enterprise, assuming various future outcomes. Share value is based upon the probability-weighted present value of expected future investment returns, which considers each of the possible future outcomes available to the enterprise as well as the rights of each share class. Although the future outcomes in any given valuation model will vary based upon the enterprise’s facts and circumstances, common future outcomes modeled might include an IPO, a merger or sale, a dissolution, or continued operation as a private enterprise. This method involves a forward-looking analysis of the potential future outcomes; it also estimates the ranges of future and present value under each outcome and applies a probability factor to each outcome as of the valuation date.

Fact pattern III: illustrative example using PWERM

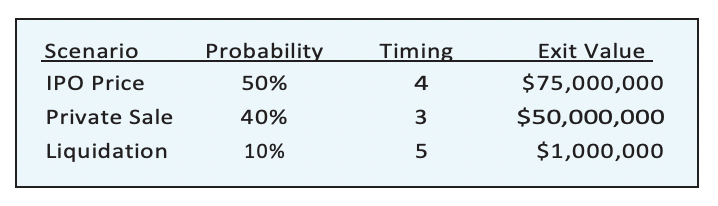

Continuing the fact pattern from the previous example, management anticipates the following exit opportunities:

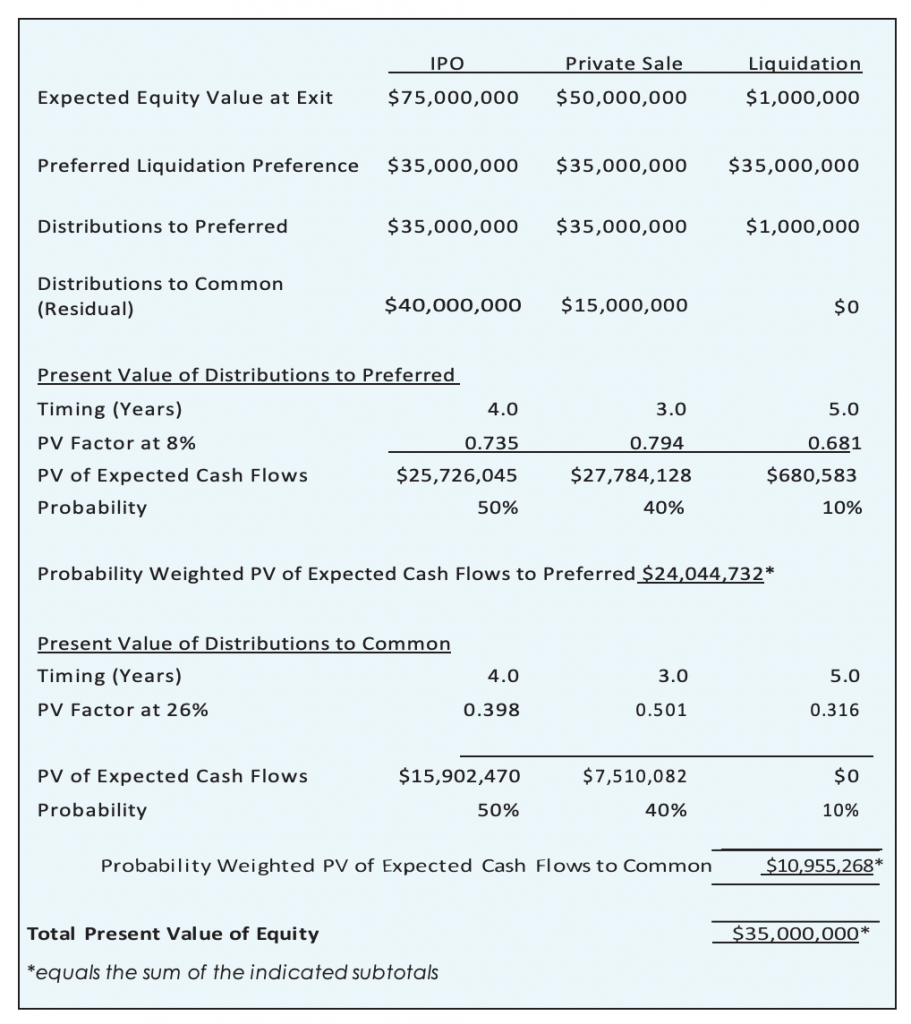

The application of the PWERM with these exit opportunities is illustrated below:

In the application of the PWERM, it may be necessary to assess the risk profile of the various classes separately. If the sum of the present values for the various classes does not reconcile to the equity value as of the valuation date, that may indicate the assumptions around the amount, timing, probability, or risk associated with the exit events should be reconsidered.

In the application of the OPM and PWERM, an appraiser would also take into account considerations for the relative control position and marketability of the various classes and any applicable discounts. For simplicity, this has not been illustrated in the earlier examples.

In certain situations, an appraiser may utilize a combination of the OPM and PWERM methodologies in tandem. This is referred to as the hybrid method.

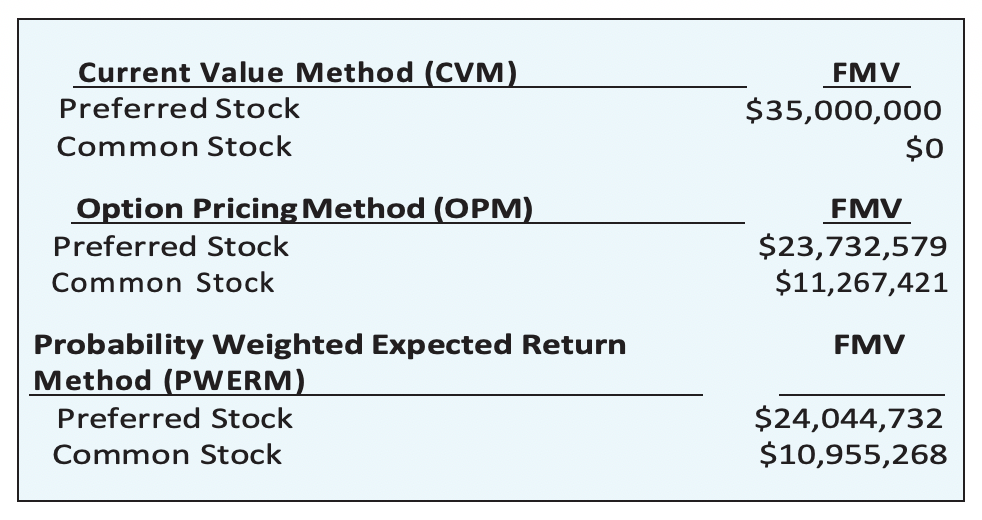

To recap, the following image illustrates the results under the CVM, OPM, and PWERM:

As you can see, in the context of a going concern not bound by an imminent liquidity event, the use of a CVM may understate the value of the subordinated securities (which are able to participate in the upside of a business).

Conclusion

The valuation process helps enterprises prepare for major transitions and milestones, such as IPOs, mergers and acquisitions, and regulatory compliance. Valuation professionals provide organizations with a clear, unbiased understanding of the value of their enterprise. Conducting a valuation of any enterprise requires a thorough understanding of the various methods to be employed. This article has provided an overview of the methods commonly employed to value various equity classes within a complex capital structure; however, it is, so to speak, the tip of the iceberg in terms of the myriad procedures that must be considered for a successful valuation.

The stakes for any organization that has reached a valuation stage are high, which is why these organizations should consider the expertise of third-party valuation specialists. The specialists should conduct each component of an intricate, complex process in a way that allows the enterprise owners the freedom to continue on with their business as usual—all while ensuring that the results are defensible and that there is no suggestion of any conflict of interest. Relying on a third-party specialist may ultimately be more cost- and time-efficient than attempting to undertake a valuation internally.

Anthony Doughty, CFA, Managing Director, KPMG

Michael Notton, CFA, CPA, Senior Manager, KPMG