Getting your pre-IPO accounting house in order

A company that is planning to go public is subject to a host of new and complex accounting requirements. These range from issues with financial statements, to providing sufficient key performance indicators (KPIs) in management’s discussion and analysis (MD&A), to providing data concerning highly technical accounting issues. Pre-IPO companies will frequently be dealing with many of these items for the first time and can find the SEC requirements to be quite burdensome. However, we have found that companies can tackle the process much more effectively by planning early and by focusing on several accounting issues that have historically raised the most red flags.

A company that has a coherent IPO plan and understands the accounting issues that have historically raised difficulties will substantially limit any surprises during the IPO process. Focusing on these accounting items early on will help to minimize any delays during the SEC comment phase. As recent volatile markets have shown, companies need to have the flexibility to file an IPO when the best market conditions are present. Having key issues resolved early, especially those that involve complex accounting rules, can make it much easier for a company to file at the most opportune moment.

Beware of the more common accounting complexities

Frequently, the accounting issues that are the most problematic are those that are particularly complex or subject to conflicting or subjective interpretations. In our experience, there are several accounting areas that warrant extra attention and that need to be considered early in the planning process. Giving these five accounting areas adequate focus can help minimize problems as the IPO date approaches. These areas include the registrant’s financial statements, SEC S-X Rule 3-05, KPIs, certain technical accounting issues, and pro forma financial information.

1) The Registrant's financial statements

Prior to an IPO, management needs to consider the appropriate structure for the entity that will be going public. It may choose to restructure to gain tax advantages or for other business reasons. For example, multiple entities may be combined to form the registrant (also known as a roll-up or put-together transaction) or corporate divisions can be carved out or spun off. The legal entity structuring used to form the registrant can add complexity and may trigger the requirement for additional financial statements to be presented in the registration statement if a “predecessor” entity exists.

The definition of “predecessor” in Rule 405 of SEC Regulation C is very broad for purposes of financial statements required in a registration statement. The designation of a “predecessor” is required when “a registrant succeeds to substantially all of the business (or a separately identifiable line of business) of another entity (or group of entities) and the registrant’s own operations before the succession appears insignificant relative to the operations assumed or acquired.” In order to determine if an entity is a predecessor entity, management should consider the order in which the entities were acquired, the size and value of the entities, and ultimately whether the acquired entity will be the main driver of the entire business’s operations.

When a predecessor is identified, the registration statement must include the predecessor’s financial information. Pre-IPO companies should be cognizant of this requirement as they are finalizing their corporate structure. This can be a tricky area since significant judgment may be required in identifying a predecessor, and it can be challenging to identify the proper set of financial statements to include for a predecessor in a registration statement.

2) S-X Rule 3-05: Financial statements of other entities

Under this potentially burdensome rule, a public company must include audited financial statements in its SEC registration statements for any “significant” business it has acquired. (This rule also applies to any planned acquisitions.) These audited statements must be submitted for either one, two, or three years, depending on the significance of the acquisition and must include a balance sheet, a statement of income, a statement of cash flows, and related disclosures.

A pre-IPO company needs to ask the following questions under Rule 3-05 to determine if financial statements are required and for what time period they will be required:

- Is a “business” being acquired?

- How significant is the acquired business?

- Has the acquisition occurred or is it probable?

Once the company has determined that an acquisition has taken place, the significance of that acquisition must be determined. The SEC uses three tests to make that determination:

- The investment test: The total purchase price of the target (adjusted for certain items) is compared to the acquirer’s pre-acquisition consolidated total assets.

- The asset test: The asset test compares the target’s consolidated total assets to the acquir- er’s pre-acquisition consolidated total assets.

- The income test: Under this test, the target’s consolidated income from continuing oper- ations before taxes, extraordinary items, and cumulative effect of a change in accounting principles and exclusive of any amounts attrib- utable to any noncontrolling interest (“pretax income”) is compared to the acquirer’s pre- acquisition consolidated pretax income.

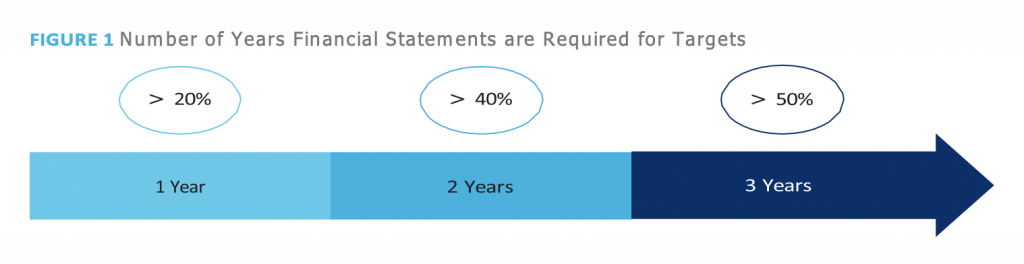

All three of the tests must be performed, and the significance level of the target is ultimately calculated based on the highest percentage reached in any of the three tests. Therefore, pre-IPO companies should be aware that an acquisition that appears insignificant under one test may be significant under another test and will therefore trigger the reporting requirements under Rule 3-05 (see Figure 1: Number of Years Financial Statements are Required for Targets).

Companies with under $1 billion in revenues that qualify for filing under the JOBS Act will be required to submit only up to two years of financial statements for recent, significant acquisitions.

Why is this rule so problematic? This requirement tends to pose significant challenges for pre-IPO companies because the targets that they purchase are frequently young companies themselves, with a less sophisticated approach towards financial statement requirements. Any company that is considering going public needs to understand these rules and analyze their impact at the time of the acquisition. Financial statements for the target should be reviewed as soon as feasible. If no adequate financial statements exist and are required under the rules, the pre-IPO company should be prepared to create them in conjunction with the target’s financial team.

Other circumstances that could require the inclusion of separate financial statements are S-X Rule 3-09, which can require separate financial statements for significant equity method investments of the registrant, and, in the case of the registration of a debt offering, S-X Rule 3-10, which can require separate financial statements of subsidiaries that are guarantors of the registrant’s debt being registered.

3) Define key performance indicators to support - Management's reporting requirements

Companies seeking to go public are required to prepare an MD&A for inclusion in the S-1, which discusses the historical performance of the business from which investors can draw guidance on future performance. This is achieved through a narrative explanation of the financial statements and other statistical data to enhance an understanding of the company’s business performance. The MD&A should provide insight through discussion of a company’s financial statements that enables investors to see the company through the eyes of the management, to enhance overall financial disclosure by providing contextual information with which financial information can be analyzed, and provide information on quality and variability of a company’s earnings and cash flows.

It is essential that management selects and prepares KPIs that effectively communicate business performance in a clearly understood manner that can be used to measure historic trends, compared with other peer companies within the same industry, and provide information necessary for an understanding of likely future business developments.

The starting point for choosing appropriate KPIs should be those that management currently uses to manage the business. These should be evaluated through a balanced view of common practice of other public companies in the industry and those needed to adequately measure and communicate achievements of management’s stated strategies. Management should be prepared to discuss their choice of KPIs and how these are relevant to the business, especially if they include metrics not commonly used in their industry.

There has been increased usage of non-GAAP (generally accepted accounting principles) measures by registrants to supplement other metrics that management considers important in running the business. While non-GAAP measures are allowed to be presented in SEC filings, the SEC has issued guidelines and has prohibited practices concerning their use and has increased scrutiny in this area recently. If a registrant considers using non-GAAP measures in a registration statement, it needs to ensure the SEC guidelines are followed.

The SEC has steadily expanded the line-item disclosure requirements for the MD&A, adding specific requirements for off-balance sheet arrangements, long-term contractual obligations, and certain derivatives contracts and related- party transactions, as well as critical accounting policies.

While the requirements of the MD&A are detailed and may seem straightforward, pre- IPO companies frequently struggle to produce a document that meets the SEC’s requirements. Companies that are not used to meeting the expectations of stockholders or analysts may have a hard time adequately explaining their business model, which seems intuitive to the management team. In addition, many pre-IPO companies may use unique metrics that are not used by similar companies in their industries. That tends to be a mistake. The SEC is looking for MD&As where the metrics are benchmarked against industry norms and that conform to the industry standard or to those used by the company’s closest competitors. This is not an area where creativity is appreciated.

Creating future projections is always a difficult process. Growth and profit projections need to be based on realistic assumptions that are shared by at least a portion of the industry. Starting early is advantageous as well; if a company is making assumptions that are different from its peers, those assumptions can be explained or possibly changed in response to SEC comments.

4) Technical accounting issues

In our experience, certain technical accounting issues demand added attention from the pre-IPO finance team. We have found that these areas have become SEC favorites when it comes to added scrutiny. These accounting issues usually involve new rules and/or those areas that may be subject to multiple or subjective interpretations. Companies who do not spend enough time on these issues risk a complicated comment period and may even find themselves subject to issuing a restatement. A restatement issued in the first few quarters after a company has gone public can result in a huge loss of public confidence, a decline in stock price, and questions from suppliers and/or customers.

Recovering from such a public event may take months or even years. Our advice—get it right the first time.

Revenue Recognition

Revenue recognition rules have always been subject to SEC scrutiny for newly public companies. New revenue recognition rules have been issued by the Financial Accounting Standards Board (FASB) and will soon become effective. Companies need to ensure that they are complying with the new rules and are using established and accepted mechanisms for recognizing revenue, even in cases where new business models are being used. We anticipate that this is one area that will receive even more attention from the SEC moving forward. In addition, adoption dates vary for public and private companies, and newly public companies need to ensure that they are ready to meet the public company timelines.

Segment Reporting

In addition to all of the consolidated financial information, companies that are engaged in more than one line of business or operate in more than one geographic area may also be required to include separate revenues and operating data for each of their business lines or geographic areas.

Generally, an operating segment is defined as a component of a larger enterprise that engages in business activities from which it may earn revenues and incur expenses; whose operating results are regularly reviewed by the enterprise’s chief operating decision maker; and for which discrete financial information is available.

The aim of segment reporting is to align public financial reporting with a company’s internal reporting in order to permit financial analysts and the public to see the overall enterprise the same way management sees it. The SEC has consistently focused on segment reporting, and these accounting issues may be particularly scrutinized in the pre-IPO context since it is common for organizational changes to take place pre-IPO.

The most critical factor in determining whether an issuer has more than one operating segment is how management runs its business. Whether an issuer can aggregate operating segments is highly fact specific, involves certain judgment calls, and depends on factors such as economic similarity, the similarity of the products or services sold, the nature of the production process, customer type, distribution methods, and the regulatory environment for the business.

The Issue of “Cheap Stock”

Another technically challenging SEC favorite is so-called “cheap stock.” Questions may arise when a pre-IPO company awards stock to employees during the 12 months before the IPO at valuations that are substantially lower than the IPO offering price. ASC 718 requires that the fair value of the equity given to employees be established on the grant date of the award; that the fair value must be determined based on available information on the grant date; and that the grant date value will be recognized as a compensation expense during the employee’s employment.

In a pre-IPO context, the value of a stock award can vary greatly in a very short period of time, and assumptions and projections may be subject to large variances. Some companies find themselves stumbling when they need to explain how a particular stock award was valued. Companies are advised to understand the accounting rules before making any stock-based compensation awards in the period leading up to an IPO and to use justifiable assumptions and/ or an independent entity to evaluate the award. Documenting all assumptions is key.

Impairment Issues

We have found that pre-IPO companies have been challenged with asset value impairment issues. Impairment issues tend to be industry specific. However, in general, companies have recently been finding it much more difficult to value their businesses and their underlying assets. Global economic uncertainty and rapid shifts in interest rates and commodity prices, among other factors, have made it tougher than ever to accurately predict future revenue and profit numbers and underlying asset assumptions.

As they prepare to go public, companies need to evaluate on a quarterly basis whether there have been any impairment triggers. If there is an impairment triggering event, companies should be prepared to calculate any impairment charge under U.S. GAAP.

5) Pro forma financial information

Another accounting area where companies are urged to spend added time concerns pro forma information. Pro forma financial information needs to be provided to reflect the impact of any IPO structuring transaction. In addition to a material acquisition, S-X Article 11 also requires pro forma financial information in a number of other situations, such as:

- Disposition of a significant portion of a business;

- Acquisitions of one or more real estate operations;

- Roll up transactions;

- The registrant was previously part of another entity; and

- Any other financial events or transactions that would be material to investors.

Pro forma financial information is intended to illustrate the continuing impact of a transaction by showing how the specific transaction might have affected historical financial statements had it occurred at the beginning of the issuer’s most recently completed fiscal year or the earliest period presented.

In particular, the rules require:

- A condensed pro forma balance sheet as of the end of the most recent period for which a consolidated balance sheet of the issuer is required, unless the transaction is already reflected in that balance sheet; and

- A condensed pro forma income statement for the issuer’s most recently completed fiscal year and the most recent interim period of the issuer, unless the historical income statement reflects the transaction for the entire

Pro forma adjustments can involve some degree of judgment calls and are therefore just the kind of accounting issue that the SEC staff may question. The finance team needs to determine whether pro forma financial information will be required and make sure that it is using widely accepted metrics when developing the company’s pro forma financial statements.

Conclusion

Going public has tremendous advantages. However, the process itself is quite time- consuming and complex. Companies that are contemplating an IPO need to plan early and understand all of the requirements and challenges. Management can easily lose control of the process because of problems with complex accounting issues, which can cause delays or even a major loss of shareholder confidence. While all filing requirements are important, paying particular attention to some of the more difficult accounting issues, and doing so as soon as possible, can help a company develop a coherent and effective IPO readiness plan that may avoid some of the most common accounting pitfalls.

In addition to focusing on these potentially perilous accounting issues, pre-IPO companies need to be cognizant of all post-IPO reporting and listing requirements. They should be prepared to establish an effective investor relations function, to issue accurate and timely 10-Ks and 10-Qs, to meet SOX compliance rules, and to meet all other rules and expectations that public companies need to follow.

Aamir Husain, National IPO Readiness Leader, KPMG

Dean Bell, Partner in Charge and U.S. Head of Accounting Advisory Services, KPMG

Brian Hughes, National Partner in Charge of Private Markets & National Venture Capital Co-Leader, KPMG

Mike Meara, Director, Accounting Advisory Services, KPMG